Payroll deduction online calculator 2023

Income Tax Calculator for FY 2022-2023. Each year youll want to calculate your expenses both ways and then choose the method that yields the larger.

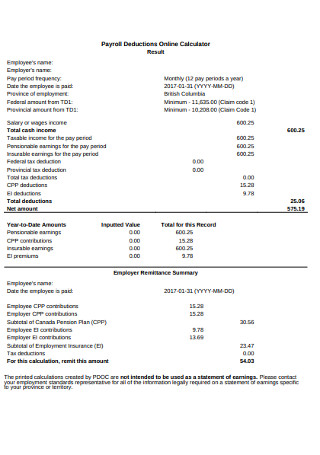

How To Calculate Payroll Deductions For Employee Simple Scenario By Sunray Liao Cpa Ca Medium

Enter your filing status income deductions and credits and we will estimate your total taxes.

. If you compute payroll manually your employee has submitted a Form W-4 for 2020 or later and you prefer to use the Wage Bracket method use the worksheet below and the Wage Bracket Method tables that follow to figure federal income tax withholding. On December 1 2021 you sign a 12-month lease effective beginning January 1. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS.

Please note this calculator is for the 2022 tax year which is due in April 17 2023. Unlike the Federal Income Tax Pennsylvanias state income tax does not provide couples filing jointly with expanded income tax brackets. But instead of integrating that into a general.

Each method has its advantages and disadvantages and they often produce vastly different results. I did create a Paycheck Calculator to estimate tax withholdings and calculate net take home pay. 1040 Tax Estimation Calculator for 2022 Taxes.

In Fiscal Year 2023 in keeping with the usual practice contractual employees may receive an increment at the employing agencys discretion. You can however claim dependent deductions on your Federal Tax Return. Terms and conditions may vary and are subject to change without notice.

PayHR provides tools for HR and Payroll professionals by providing online calculators for Income Tax Statutory. When you figure how much income tax you want withheld from your pay and when you figure your estimated tax consider tax law changes effective in 2022. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID. Payroll Payroll services and support to keep you compliant. If your EOD falls between January 1 and June 30 you will receive your increment in January 2023.

PayHR Income tax calculator is an simple online tax calculator tool that helps you to estimate your tax based on your income. IRS standard deduction Earned Income Tax Credit EIC. Payroll taxes are always deducted directly from each paycheck so you rarely have to pay additional payroll tax on your income tax return.

Many companies including the military have made their employees W-2 forms easy to get online. Where your payroll software has been updated youll automatically receive the increased allowance of up to 5000 for 2022 to 2023. IRS standard deduction Earned Income Tax Credit EIC Child tax credits Student loan interest deduction.

2022 and 2023 you can only deduct the rent for 2021 on your 2021 tax return. Self-Employed TurboTax Live TurboTax Live Full Service or with PLUS benefits and is available through 12312023. Terms and conditions may vary and are subject to change without notice.

The Payroll Tax also known as the FICA tax refers to the two mandatory taxes paid by all employees which contribute to the Social Security and Medicare programs. In the vast majority of cases its best for married couples to file jointly but there may be a few instances when its better to submit separate. The payroll tax rate reverted to 545 on 1 July 2022.

Learn how you can find and get a copy of your W2 online for free during the 2021 2022 2023 tax filing season. Medical Treatment Special Needs or Carer Expenses of Parents up to RM 5000. See Limit on housing expenses under Foreign Housing Exclusion and Deduction in chapter 4.

For 2021 the maximum amount of net earnings from self-employment that is subject to the social security part of the self-employment tax has increased to 142800. Payroll Self Service aka NYS Payroll Online. Positions taken by you your choice not to claim a deduction or credit.

As a new employer I set out to create a Payroll Calculator but in the process learned that there were too many laws and regulations associated with payroll to risk using a spreadsheet for calculating payroll. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. You are a cash method calendar year taxpayer.

If your EOD falls between July 1 and December 31 you will receive your increment in July 2022. If you need to estimate your yearly income tax for 2022 ie. You can also claim the Employment Allowance by.

You can deduct the rent for 2022 and 2023 on your tax returns for those years. New Yorks 529 College Savings Program Flexible Spending Accounts Morton Lane Federal Credit Union State Employees. Check e-file status refund tracker.

Additional Payroll Deduction Options. Terms and conditions may vary and are subject to change without notice. Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later.

Payroll taxes are always deducted directly from each paycheck so you rarely have to pay additional payroll tax on your income tax return. Pennsylvanias maximum marginal income tax rate is the 1st highest in the United States ranking directly below Pennsylvanias. Pennsylvania collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Assessment year 2023 just do the same as previous step with your. 1 online tax filing solution for. The IRS strongly encourages most couples to file joint tax returns by extending several tax breaks to those who file together.

The Actual Expenses method or 2. 43 - Georgia Dependent Deduction Unlike most states Georgia does not have a dependent deduction. For 2021 the standard deduction amount has been increased for all filers.

Self-Employed TurboTax Live TurboTax Live Full Service or with PLUS benefits and is available through 12312023. For annual Australian taxable wages over the 13 million threshold the deduction will change to 1 for every 7 of taxable wages over this amount. This tax calculator will show comparison of both tax regime.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Changes from January 2023. The Payroll Tax also known as the FICA tax refers to the two mandatory taxes paid by all employees which contribute to the Social Security and Medicare programs.

W-4 withholding calculator. Married couples have the option to file jointly or separately on their federal income tax returns. PCB Calculator Payroll EPF SOCSO EIS and Tax Calculator Search.

Tax law changes for 2022. 44 - Georgia Itemized Deductions Georgia allows itemized deductions and you can claim the same itemized deductions on your Georgia tax return as you do on your Federal tax. Estimate your tax refund with HR Blocks free income tax calculator.

2020 and before January 1 2023. Standard deduction amount increased. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or.

The IRS offers two ways of calculating the cost of using your vehicle in your business. From 1 January 2023 the deduction range will increase which means a reduction in payroll tax for small and medium businesses. Tax Deduction For Lifestyle up to RM 2500.

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How To Calculate Payroll Deductions For Employee Simple Scenario By Sunray Liao Cpa Ca Medium

When Are Taxes Due In 2022 Forbes Advisor

Estimated Income Tax Payments For 2022 And 2023 Pay Online

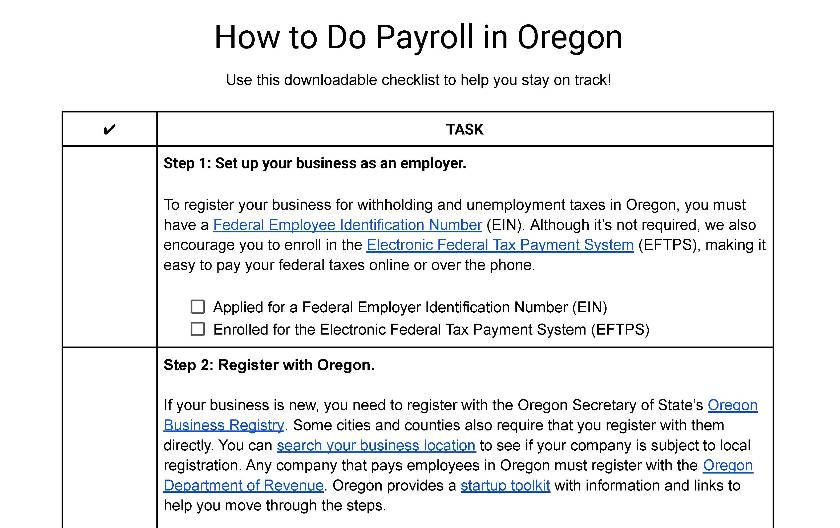

How To Do Payroll In Oregon What Employers Need To Know

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

Solved Federal Taxes Not Deducted Correctly

Payroll Template Free Employee Payroll Template For Excel

Online Payroll Calculator Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware Automotive Parts

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

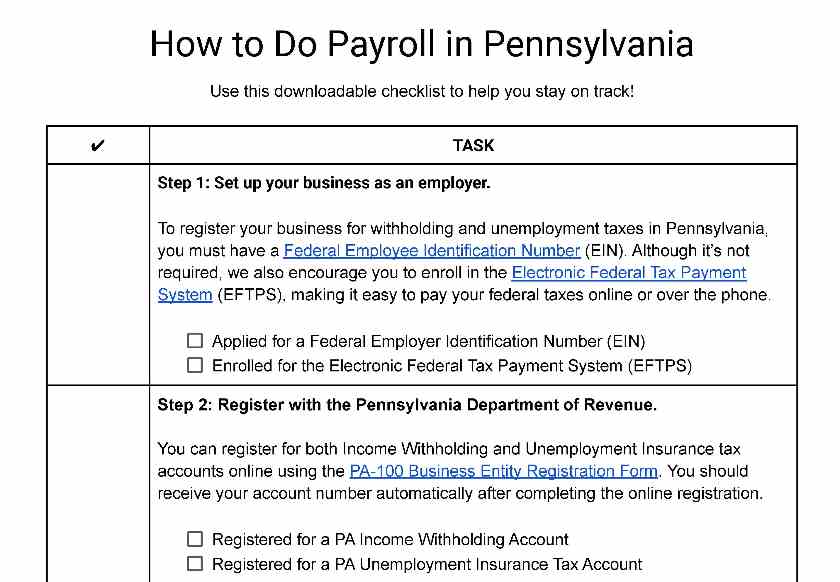

How To Do Payroll In Pennsylvania What Every Employer Needs To Know

Solo 401k Contribution Limits And Types

Llc Tax Calculator Definitive Small Business Tax Estimator

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

Self Employed Health Insurance Deduction Healthinsurance Org

Income Tax Calculator For Fy 2022 23 Ay 2023 24 Lenvica Hrms

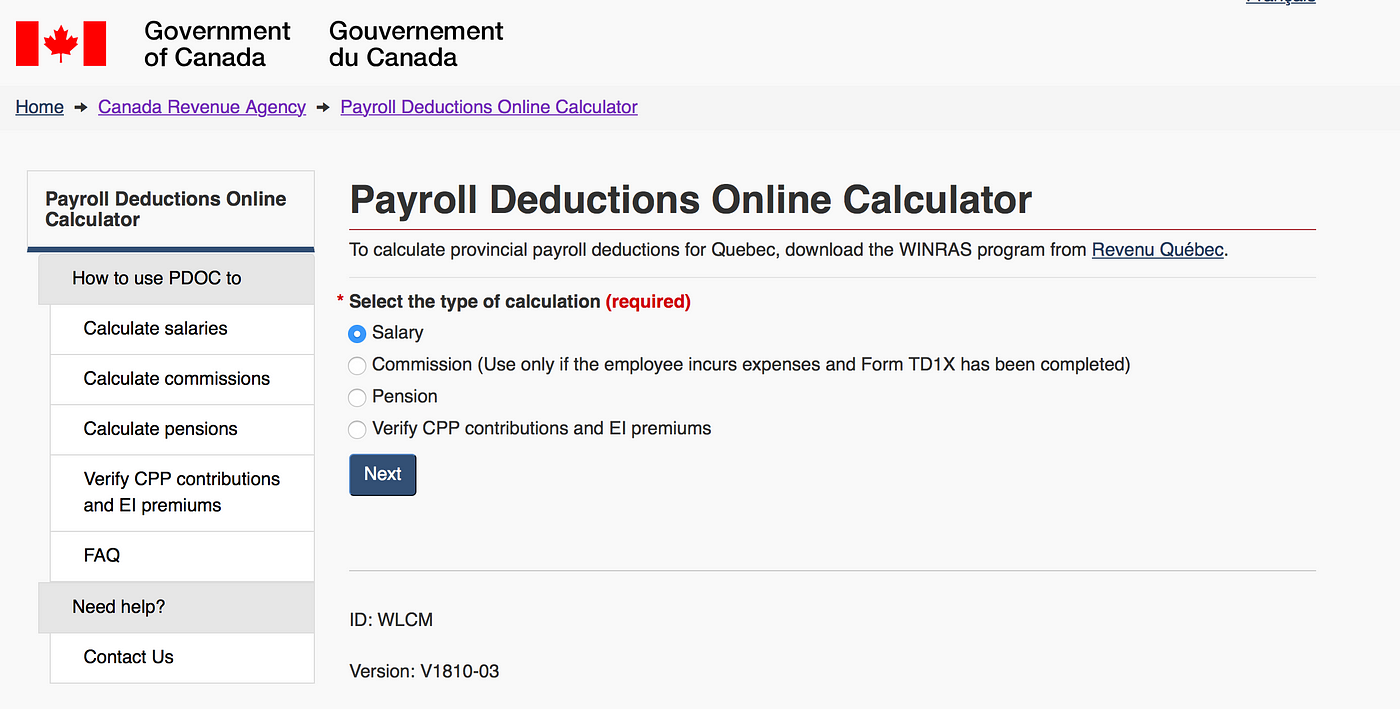

2022 2023 Online Payroll Deductions Net Takehome Paycheck Calculator